What is Credit,

What are some of our retirement benefits,

Is there any knowledge to help me early in life...

Through time, there are some things we should know. There are choices we need to make and we should be aware of these before hand. Knowledge that would help us through the journey we call life.

From the time we are in our youth, to the time we grow older, there are things that happen we should know about. From general concepts, investments, credit, to retirement, these are things we should be aware of before hand. The quest for knowledge gives you power in ways you may not realize. If we had information of certain things before we got to that point, it would help us get ahead in life. We hope these things find the way to our hearts and hope we have a way to store this information. You only get one chance to live and enjoy life. We should understand the rules of man, and be ahead of his games. Lets not try to figure things out the last minute, settling for what we would have changed with fore knowledge. What if, we would have thought about getting ahead of our little journey?

Should we live life on the whim. Do the school systems teach us about the different tools we have in life to get ahead financially, or teach us about our retirement. Do our parents have the talks with us about investments, credit, or retirement. Are they required or capable, and do they have the responsibility to teach us any of it.

Investments, Credit, and Retirement Plans are not the same for everyone. Depending on the different situations you have going on in life, everyone will plan for their future differently. You may not be taking the same plan of action, or starting as early as your best friend is. None of the strategic outcomes, can give you a definite plan for a future... life constantly changes. The wisest thing, is to think about it, and definitely have or make a plan. Whether someone is a financial adviser or private investor, we should always consider their thoughts when guiding us... We don't have to take action as quick as they suggest. Some people may not be capable of taking advantage of particular situations in the timing they are suggesting. Don't be pushed into a situation, knowing life will present struggles, but, we don't want to wait too late for moving forward. In reality, only you would know the spot you are in, or what would be the comfortable spot you would be capable of extending yourself to. It's always important to remember, growth in not always constant, sometimes situations pop up, and things go down in society. There isn't anything that would offer a constant assurance.

With this being said, taking a chance and moving forward is associated with everything we are talking about. Whether its starting your credit, investing, or planning for a retirement, the earlier we start, the better chances we will have to make it better through our preparations. You must trust in your choices, seeking counsel about moving forward with any of the subjects we are talking about.

Questions

The scholastic systems teach us the main things we need to get by in life, following the rules and the laws. In school, we are taught to read, write, arithmetic, history, and the sciences. This is a great start for everything to come in life. The scholastic systems doesn’t teach you in depth about investing, credit, and retirement. The simple fact is, these things are different in all of our situations, and ever changing. It’s not that they don’t teach you in depth about these things, they give you the tools to be capable of applying yourself to learn about them, and the rest of life. The responsibility of learning and moving forward is yours. In reality, not everyone will learn or use all these things. Different people will learn these things at different points in life. Every few years, life and our goals change. Whether it’s the cards we are dealt, or, different situations as life moves on. We are all in different points in our life to learn about our future options.

That is one of the most tricky questions in life. For most of us, our parents are just 20 years older than us. In reality, our parents are barely in front of us. Some of them don’t even know what it is to be responsible enough to have children, but here comes our new baby. They are learning the ins and outs of the systems as you are starting your beginning process. Remember, everyone learns at different points in life. Your parents may start learning just before, or at the same time as you. These are your responsibilities, no one else’s. Ultimately, you make your own choices in life, “you end up where you put yourself “… We all have different hopes and dreams, therefore, no one has an idea of what your reality of life is. Not everyone does the right thing the first time. Different situations pop up, and the outcomes may have factors as to why things take a temporary turn, for the better, a minor set back, or for the worst. No one can see the future, and no one can predict outcomes. As for what should be the most responsible thing to do, Study Early, Learn through Time, Take a Chance(don’t jeopardize your future, be wise), Be Responsible, and make sound decisions to move forward constantly. You only live once.

Credit is one of the most important things you will build in life. You have to build credit in your life. We are not saying you need to have credit cards. Although, it is one of the most popular tools used to achieve a good credit score really fast, and there can be benefits, if used correctly. With good credit, you will get cheaper interest rates for loans to buy items. You never want to over extend yourself, this will have a negative impact on your credit score. The general rule of thumb, talked about by everyone, is never live above or beyond your means. You need to be honest with yourself, realize who you are, so you may be happy and live accordingly. The least amount of credit you owe on, is more you will have, to invest and/ or save.

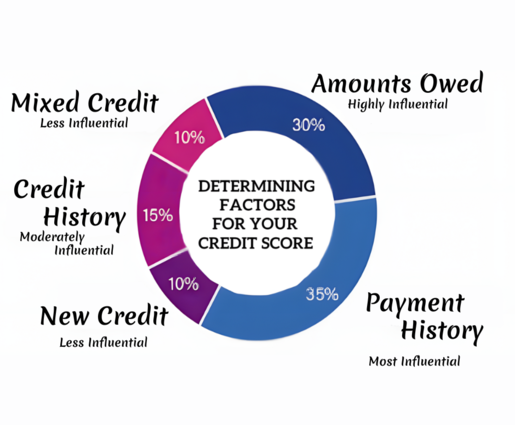

Building credit is not a quick process, but in the big picture or life, it can happen quickly. Although credit card companies will advertise saying they can build you credit, or restore it in months… this may not always be the case. People and companies will say or do anything to secure your business (your business with them is to pay interest), before the next credit company takes it away. It actually doesn’t take that long to raise your credit score, just have patience, and it will happen. Credit revolves around your payment history(35%), the amount you owe(30%), your credit history(15%), mixed credit(10%), and new credit(10%). These categories should not be neglected in any way. Credit is a thing you want to take seriously. Like we said before, the more interest you owe, the less you will have to save and/ or invest. We will have a section on building credit in our Credit Pages.

That would be a question for you and your parents. You need to be honest and responsible. In reality, being honest with yourself, you will know how soon you should start thinking about building credit. If you are a minor, it is hard to build credit. There is a term called piggybacking in the credit industry. Its when someone puts you as a trusted, authorized user on their credit. In turn, this helps you, by boosting your credit. Unfortunately, this doesn’t always work, due to some companies not report users. Some agencies only report on the individual who originally applied for credit. Start as early as you can. The bank will allow you to take out a secured loan, meaning you can put some money down, and borrow against that amount. This does work fairly good and fairly fast. You are paying interest on your own money, but that is the basic concept of credit, but later you will not be borrowing against yourself. The good side is, in your long life history, this will only be for a short time. Some people start building credit after their teen years, and there is nothing wrong with this. We are all in different situations, and what is good for some, may not be the best time for others.

Well that is the age old opportunity everyone would love to have. You have to remember, we are taking out loans for items we can’t afford, but want to have and enjoy. This in turn will raise, lower, and slowly boost our credit score. These are all good things. Credit scores don’t always stay the same, and when handled responsibly, they raise faster than we would image. These ways can be a win, win situation on our part (remember not to over extend yourself, it can have a negative impact). To answer that question, we have to stay in the best debt ratio, to pay extra on the items we have borrowed for. More of this will be explained later in our credit and banking areas. Remember you are the one initiating the loan process. In some instances, you may dictate some of the payment options you will be applying for.

The answer to that is simple, but, it is ever changing. This answer is different for every individual, group, affiliation, race, sect, and the list goes on and on. Investing is based on ones chances he takes, with what ever you feel like putting your money or time into. We would hope for some sort of growth, whether it be financially or some sort of property(not meaning just land). Our best investment is the chance we take, sometimes on ourselves, or a product of choice, for growth, prosperity, and advancements. Nothing is guaranteed, as a reminder, investments go up or down. We will cover a little more in articles to come.

Owning a credit card is an option you can use, enjoy, and move forward with. We first have to understand there is a difference between a NEED… and a WANT… Credit is one of the most important things you will build in life. We are not saying you need to have credit cards. Although, it is one of the most popular tools used to achieve a good credit score in a decent amount of time. With good credit, you will get cheaper interest rates for things you will get a loan for. The least amount of credit you owe is more for you to invest elsewhere or save. Credit cards are not something to abuse, you should use them wisely. You should never use a credit card to appear that you can keep up with the Joneses. You are only building debt for yourself. You can use them to buy everyday needs, to get back cash, save points for something you want, or take that trip you deserve. The important this is to always pay off your balance at the end of every month, if you are capable. Some people can pay of cards every week, other week, once a month, or every couple of months. Extending your payments past the monthly process forces you to pay unwanted interest.

Credit cards were designed to allow you to borrow a fixed amount of money, for a given period of time. If we are capable of paying off the balance before the end of the month, we do not have to pay interest for using the funds. On the other hand, if we can’t pay off the balance, we will be paying high interest charges. Paying any kind of interest charges to credit card companies or banking institutions, is what we would like to avoid. There are things like homes, vehicles, campers, boats, machinery… these are the things most people can’t afford to pay cash for. Most people set up good credit, and go to a banking institution to borrow for these items. Some people or companies have the money, and use credit cards for the perks, paying them off by the end of the month or months later. In special situations, not wanting to take from their savings, some will pay credit card interest for a few months. You would hate to take from your savings, putting yourself in a bad financial spot. Sometimes people realize it is much cheaper to pay for a couple/ few months of interest, than years of compounded interest. They do not have to take a day off to apply for a loan, to possibly get denied. You have to make a choice to get an item, considering the obligations to payback the funds as quick as possible. There are others who pay everyday billing, paying it off before the end of the month. They are focused on getting cash back or point incentives. Doing all these scenarios will help boost and build credit, while using credit cards in everyday fashions.

Like every thing else in life, there are good and bad situations in everything. These are some of the things to think about, right from the beginning. Are you responsible enough to charge only the items you need, or to live with on a daily basis? Do you intend on paying your card off on a monthly basis (meaning you will pay off the balance) not faltering. Do you realize there is fraud with this establishment, just like anything else in the world. Are you prepared to check for false charges by accidents or thieves who steal identities. Just as we are capable of moving forward with these items, we have the possibility of being held back, by unanticipated instances.

Retirement in the long run, is basically a choice. Retirement is something we do, placing closure to one chapter of life, opening a new chapter, with anticipation of relaxation and enjoyment. For many, it’s the time we reach, ending a time period of work, entering a time period of rest and relaxation. We are going to talk about this part of retirement. We will talk about personal retirement plans, and the Social Security Administration’s retirement plan (tax payers have contributed to). We would hope for the scenario of spending the rest of our time, healthy and financially stable with our loved ones. Retirement should be a relaxing and enjoying time, from making the wisest decisions for our future well being. Retirement comes in many forms. We could possibly write 100 books on it, and still never reach the beginning of explaining it’s differences, what to do, or the leisure we could/ should take and enjoy during it. The focus on our topic is a basic understanding of retirement plans, personal investments, and the Social Security System we have contributed to. Right off the back, this is not the guide that will tell you how to make your choices, and live a spectacular life from here on. That article or document may never exist, with so many different interpretations; to imagine building and taking time off to enjoy the rest of our lives. Lets face it, we all live different lives, and we all have something different we want to achieve at some point. From these interpretations, will make our own choices, for the care we will receive to live the rest of our lives. We will explore the possibility of coverages in the articles provided…

Only you will be capable of making an investment, and having the understanding of how far you are willing to go. Life constantly changes, and you are not guaranteed anything.

Don’t be scared to buy something on credit, whether its a loan, or a credit card (be wise and responsible). Building credit is one of the best things you will do in life. What kind of perspective do you have, is the glass half empty, or is it half full? We all have to pay interest somehow, somewhere. Why not use it to your advantage. You can have positive outcomes, to advance yourself for future possibilities.

Retirement is choices based on our life’s principles. We are not all dealt the same hand in our journey. Being wise and responsible with the choices we make, we can provide for outcomes of great proportions.